UOB's Foreign Exchange Access (FX Access) provides you with a comprehensive suite of FX-related solutions that will help you provide for all your foreign currency needs. Be it for your current or long term needs, or even for capital appreciation purposes, FX Access solutions leverage on foreign exchange fluctuations to give you potentially higher returns on your currency investments.

Available currencies: United States Dollar (USD), Australian Dollar (AUD), British Pound (GBP), Canadian Dollar (CAD), Chinese Yuan (CNH), Euro (EUR), Hong Kong Dollar (HKD), Japanese Yen (JPY), New Zealand Dollar (NZD), Singapore Dollar (SGD) and Swiss Franc (CHF).

Minimum Amount: S$50,000 or equivalent in other currencies.

Enjoy preferential exchange rates for your foreign currency needs.

How does it work?

-

Call your UOB Relationship Manager / Treasury Specialist for the latest exchange rates on your selected foreign currency.

-

Enjoy preferential exchange rates for amounts more than S$50,000 or its equivalent in foreign currency.

Who is it for

Clients who have an immediate need for foreign currency.

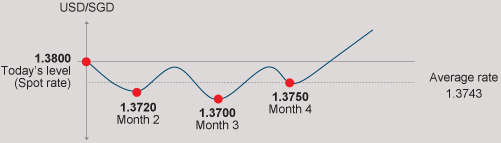

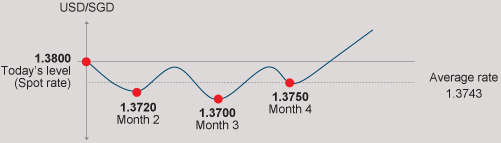

Take advantage of short term price fluctuations by averaging out for foreign exchange conversion rate.

How does it work?

You can buy USD in partial lots to average out the short term price fluctuations.

*For illustration purposes only.

Who is it for

Clients who are bullish on a currency in the medium to long term, but unsure about its short term movements.

Buy selected foreign currency at your desired level without the need to watch the market.

How does it work?

You can place an FX Order to buy AUD at your desired price (For eg. AUD/SGD 1.0200).

*For illustration purposes only.

Who is it for

Clients who prefer to buy the alternate foreign currency at a specific price, and do not have an immediate need for the alternate foreign currency. Clients must also be willing to take the risk that the alternate foreign currency will not be purchased if the desired price level is not reached.

Seize opportunities to capitalise on foreign exchange movements and earn potentially higher yields on your currency investments.

How does it work?

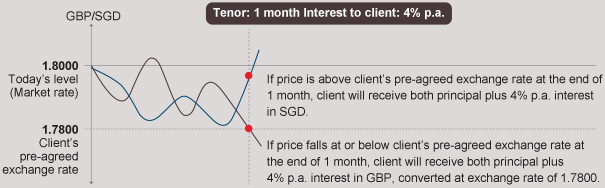

With SGD as your base currency paired against the GBP at your preferred pre-agreed exchange rate, you will earn an interest during the tenor, with the possibility of converting to GBP at your desired price level.

*For illustration purposes only.

Who is it for

Clients who have underlying needs for the alternate currency (eg. children's overseas education funding, property loans etc) or wants to potentially gain from foreign exchange investments.

|

|

Scenario

|

|

Mr Lim owns a property in the UK that is serviced by a loan in British Pounds (GBP), on a monthly basis. His current property loan interest is at 4%.

|

|

|

|

|

His FX View

|

|

GBP could depreciate in the short to medium term.

|

|

|

|

|

Our proposed FX solution: MaxiYield

|

|

With Maxiyield, Mr Lim will potentially benefit from buying GBP at a lower exchange rate and at the same time, earning a yield which can be used to potentially offset the property loan interest he is paying.

|

|

|

|

Scenario

|

|

Mr Tan travels to the US frequently for business and he likes to buy and hold US Dollars (USD) whenever the exchange rates are favourable. He realises that the USD is more volatile during US trading hours as most US economic data are released during US trading hours.

|

|

|

|

|

His FX View

|

|

The US FX market will be volatile this week with major announcements to be made and he does not want to miss out on this opportunity.

|

|

|

|

|

Our proposed FX solution: FX Order Watch

|

|

With FX Order Watch, Mr Tan can set a 'Buy' order at his desired USD/SGD exchange rate without having to monitor the markets 24 hours a day himself. The pre-determined funds he set aside will be converted to USD when his desired price is met.

|

|

|

Call our 24-hour UOB Wealth Banking Hotline at 1800 222 1881 (Singapore)

or +65 6222 1881 (overseas).

|

|

|

|

|

Speak to your UOB Relationship Manager.

|

The above information shall not be regarded as an offer, recommendation, solicitation or advice to buy or sell any banking product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of banking products is qualified in its entirety by the terms and conditions of the banking product and if applicable, the prospectus or constituting document of the banking product. Nothing in this document constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisors about issues discussed herein.

Foreign Currency Investments

There are inherent risks involved in any investment, such as foreign exchange risk, sovereign risk and interest rate fluctuations. Adverse foreign exchange rate movements could erase your deposit interest earnings completely, reduce the original capital amount or increase the quantum of loan payment substantially. The value of your redemption amount/returns on deposits at maturity may be less than your principal investment amount on conversion if the prevailing exchange rate moves against your favour. Exchange controls may also apply from time to time to certain foreign currencies that may affect the convertibility or transferability of that currency.

UOB MaxiYield

UOB MaxiYield is a Dual Currency Investment which has risk and investment elements and is not a fixed deposit. It is also not an insured deposit within the meaning of the Deposit Insurance and Policy Owners' Protection Schemes Act 2011. This investment product offers premium interest rates as may be agreed between you and United Overseas Bank Limited ("UOB") with an embedded option granted by you to UOB. In the event that UOB exercises the said option, the value of your investment in the Base Currency will be converted into the Alternate Currency, regardless of whether you wish to be paid in this currency at that time. The value of your redemption amount at maturity may be less than your principal investment amount on conversion if the prevailing exchange rate moves against your favour. Exchange controls may also apply from time to time to certain foreign currencies that may affect the convertibility or transferability of that currency. It is advisable for you to seek advice from a licensed or an exempt financial adviser before making a commitment to purchase the product. In the event that you choose not to have a licensed or an exempt financial adviser, you should consider carefully whether the product is suitable for you in light of your financial needs, investment goals and objectives and risk appetite. UOB MaxiYield is an investment product that requires you to hold the product to maturity with a right given to UOB to terminate prematurely upon occurrence of certain Extraordinary Events stipulated in the MaxiYield Facility Agreement. Unless UOB otherwise agrees, the investment amount cannot be withdrawn by you, whether partially or in whole, prior to its maturity. If UOB allows for any early withdrawal, UOB shall be entitled to deduct from the investment amount, any loss, costs, charges and/or expenses incurred by UOB (including but without limiting to UOB's unwinding or termination of its hedging and/or funding position) and such other administrative and other charges as UOB may impose. In such instances, you may receive less than the principal investment amount.

The UOB MaxiYield will be governed by the MaxiYield Facility Agreement and the related Confirmation Note as agreed between you and UOB.

UOB Global Currency Premium Account

The UOB Global Currency Premium Account is governed by the Bank's prevailing Terms and Conditions Governing Accounts and Services and Additional Terms and Conditions Governing Accounts and Services, available here.

Long-Term InvestmentsThese investments may help stabilize your portfolio through diversification.Find out more >

Long-Term InvestmentsThese investments may help stabilize your portfolio through diversification.Find out more > Short-Term InvestmentsThese investments help you potentially capitalize any market opportunities that may arise.Find out more >

Short-Term InvestmentsThese investments help you potentially capitalize any market opportunities that may arise.Find out more >